Our first edition of Strata InFocus is live! Download your copy here.

How the Levy Cycle Works

- After the Annual General Meeting (AGM), levies are struck for the upcoming period.

- Your levies are based on the budget that was approved at the AGM.

- Your levies contribute to operational expenses of the building. These may include items such as insurance, garden maintenance, utilities and more.

- A levy notice will be issued approximately one month before the due date.

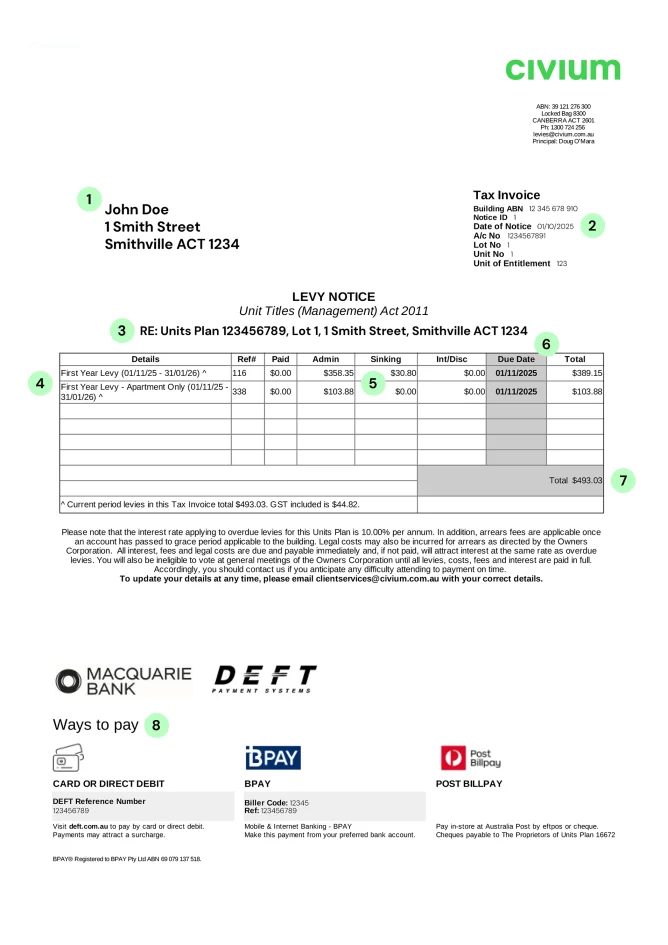

The billing name and address associated with the property.

This is the date that the notice has been issued.

The plan number, lot number and street address of the property.

The levy period is the timeframe you are paying towards (usually shown as a quarterly period in advance on the notice).

The notice shows how your payment is split between the administrative and sinking funds. For example, $300 to the admin fund and $100 to the sinking fund.

The administrative fund is the fund from which the Owners Corporation pays its day-to-day expenses related to the running and maintenance of the common property.

The sinking fund is a dedicated fund used to cover major, long-term expenses for the upkeep and renewal of common property. This is known as the capital works fund in NSW, and the maintenance fund in Victoria.

This is the date by which the levy payment is due.

This is the total amount due for the levy. If there are multiple levies or schedules, each will have its own total above.

You can pay by DEFT (card or direct debit), BPAY, or at the post office.

Pro Tip: Keep your DEFT reference number for correct allocation.